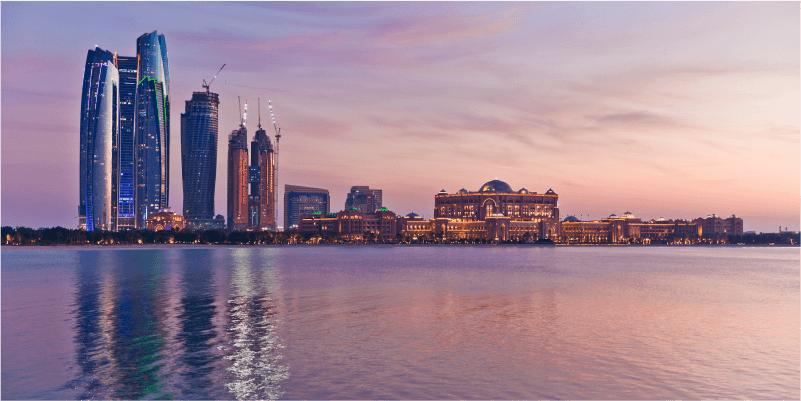

The capital city of the UAE, Abu Dhabi is a thriving market with economic and real estate investment growth. It offers a variety of property options, from luxury villas to waterfront apartments with long-term stability, capital appreciation and high rental yields.

Primarily supported by real estate businesses, the top 100 real estate companies in Dubai cater to diverse property developments in different areas. Likewise, Abu Dhabi has its own areas specialized for each property type, making its real estate industry dynamic and lucrative for local and foreign investors.

Increasing demand for properties is bolstered by megaprojects, world-class infrastructure and investor-friendly policies. These factors together make Abu Dhabi an enticing destination for real estate investments.

List of top 10 high ROI areas in Abu Dhabi

The following high ROI areas for property investment in Abu Dhabi support the growing and diversifying property preferences and significantly contribute to the sector’s growth.

| # | Area | Average ROI | Property Types | Upcoming projects | Key Amenities |

|---|---|---|---|---|---|

| 1 | Al Reem Island | 8.50% | Luxury penthouses, apartments, waterfront villas | Reem Hills, Renad Tower, Marlin Phase 2 | Shopping malls, restaurants, parks, beaches |

| 2 | Saadiyat Island | 4.24% | Luxurious apartments, penthouses, townhouses | Saadiyat Lagoons | Museums, sports venues, restaurants |

| 3 | Yas Island | 7.26% | Apartments, villas | West Yas, Sama Yas | Malls, beaches, Ferrari World, Yas Marina Circuit |

| 4 | Al Raha Beach | 6.34% | Villas, apartments, townhomes | Brabus Island, Grove Gallery Views | Malls, beaches, watersports |

| 5 | Khalifa City | N/A | Villas, townhouses, apartments | Granada, Almeria, Reportage Village | Schools, supermarkets, parks, fitness centers |

| 6 | Al Maryah Island | N/A | Luxury apartments, commercial offices | Al Maryah Central | The Galleria Mall, Cleveland Clinic, luxury hotels, waterfront promenade |

| 7 | Masdar City | N/A | Eco-friendly apartments, offices | Plaza, The Gate, Oasis Two | Schools, tech clusters, retail zones |

| 8 | Mohammed Bin Zayed City (MBZ City) | 91.13% | Villas, townhouses | N/A | Schools, shopping centers, public parks |

| 9 | Al Ghadeer | 8.66% | Villas, townhouses, apartments | Al Ghadeer Phase 2 | Parks, schools, retail, recreational facilities |

| 10 | Nurai Island | N/A | Ultra-luxury villas, beachfront homes | N/A | Private beaches, sports |

Source: Bayut

*The above data is subject to market changes and modifications.

Factors affecting ROI in Abu Dhabi’s real estate

These factors have an influence on the ROI growth, so understanding them is crucial.

Rental yields: Comparing the annual rental income percentage with the property price.

Capital appreciation: The surge in property value over a long time.

Demand and occupancy rates: Increasing rental demands sets a steady income stream.

Infrastructure and connectivity: Accessibility and proximity to transport links, business districts and amenities.

Government initiatives: Tax incentives, investor-friendly policies and residency options support ROI growth.

Investors and professionals should understand market trends and client preferences to meet the increasing property demands. This sets the path for higher ROI and business growth in a competitive market. Real estate professionals can leverage a growth platform tailored for the UAE real estate. It offers precise insights with advanced tech features, helping businesses and professionals curate strategies that fit with client preferences.

Overview of best ROI areas in Abu Dhabi

1. Al Reem Island

One of Abu Dhabi’s most sought-after investment and residential destinations. Located close to the city center, the area offers high-rise apartments with high-class amenities, stunning waterfront views and a vibrant community atmosphere. Several leading Abu Dhabi real estate companies have played a key role in shaping Al Reem Island, making it a prime location for both investors and residents.

Why invest?

- High rental yields from 7-8%, as reported by Bayut

- Proximity to top educational institutions and business districts

Upcoming projects: Reem Hills, Renad Tower, Marlin Phase 2

2. Saadiyat Island

Saadiyat Island is a luxury waterfront community known for its high-end lifestyle and cultural appeal. Home to iconic infrastructure like the Louvre Abu Dhabi and luxury resorts, the district attracts wealthy residents and tourists.

Why invest?

- Strong demand from high net-worth individuals

- Premium waterfront properties with high property value appreciation

Upcoming projects: Saadiyat Lagoons by Aldar Properties

3. Yas Island

It is one of Abu Dhabi’s renowned leisure and entertainment hubs, which is home to Ferrari World, Yas Mall and Yas Marina Circuit. The area features a mix of villas, townhouses and luxury apartments.

Why invest?

- High demand from tourists for short-term rentals

- World-class leisure attractions

Upcoming projects: West Yas & Sama Yas by Aldar

4. Al Raha Beach

Al Raha Beach is an upscale waterfront area, offering a mix of villas and luxury apartments with direct beach access. It provides ideal opportunities for families and professionals who seek resort-style living experience.

Why invest?

- Enticing rental yields due to beachfront amenities

- Increasing demand from working professionals in Khalifa City and Al Raha

Upcoming projects: Brabus Island, Grove Gallery Views

5. Khalifa City

Khalifa City is well known for its affordability and spacious villas. It is highly suitable for families and professionals because of its proximity to schools, business hubs and malls.

Why invest?

- Strong rental demand and affordable property prices

- Close to Abu Dhabi International Airport and business hubs

Upcoming projects: Granada, Almeria, Reportage Village

6. Al Maryah Island

It is Abu Dhabi’s central business district and a prospering financial hub. With residential and commercial developments, Al Maryah is a prime choice for investors and investment companies in Abu Dhabi.

Why invest?

- Luxury waterfront properties with premium rental rates

- High demand from working professionals in the financial district

Upcoming projects: Al Maryah Central

7. Masdar City

Masdar City is an emerging sustainable community that focuses on green living. It features a mix of eco-friendly properties and affordable apartments.

Why invest?

- Strong government support for sustainable developments

- Increasing demand from environment-focused property buyers

Upcoming projects: Plaza, The Gate, Oasis Two

8. Mohammed Bin Zayed City (MBZ City)

MBZ City is a rapidly growing suburban community, featuring affordable and spacious villas.

Why invest?

- High occupancy rates due to affordable property prices

- Connectivity to major highways and business hubs

Upcoming projects: N/A

9. Al Ghadeer

Al Ghadeer is a peaceful and affordable residential community located between Abu Dhabi and Dubai, developed by leading property developers in Abu Dhabi to offer accessible housing with modern amenities.

Why invest?

- Affordable investment entry point

- Strategic location between Abu Dhabi and Dubai

Upcoming projects: Al Ghadeer Phase 2

10. Nurai Island

Nurai Island is a private island development with ultra-luxury beachfront resorts and villas. With high-end amenities, crystal-clear waters and a serene environment, it makes the area one of the prestigious locations in Abu Dhabi.

Why invest?

- Exclusive private island with world-class luxury properties

- High demand for high-end holiday rentals and long-term investments

Upcoming projects: N/A

Conclusion

Abu Dhabi’s real estate market offers different segments like commercial, residential, luxury, entertainment and business spaces. Developers and real estate businesses are making use of these opportunities.

Areas with the best ROI in Abu Dhabi are developed specifically to meet every client's preference. Due to the influx of investors, tourists and residents, the right time to invest and to gain a higher ROI is now.

With a unified solution like a CRM platform for real estate in the UAE, managing different property types and client segments becomes more efficient. Its robust tool stack allows businesses to handle everything from affordable to luxury segments seamlessly.

Disclaimer: Retyn does not promote or support any of the companies or services mentioned in the list. The data presented is compiled through online and market research and does not reflect our priorities in any manner.